What are school district levies?

Levies are funding packages that provide a percentage of Issaquah School District’s operating budget. The state pays for “basic education” but does not cover all expenditures. Local voters are asked to renew ballot measures every 4 years to ensure funding for all programs with a portion of their property taxes.

Levy dollars flow directly into the classroom, providing funding for program enhancements and supplementing the state’s minimum basic education allocation. The current Issaquah School District levies expire on December 31, 2022. To continue to fund the programs we now have in our schools, the renewal levy will need to be approved by voters sometime in 2022.

Levies require a 50% + 1 majority vote to pass.

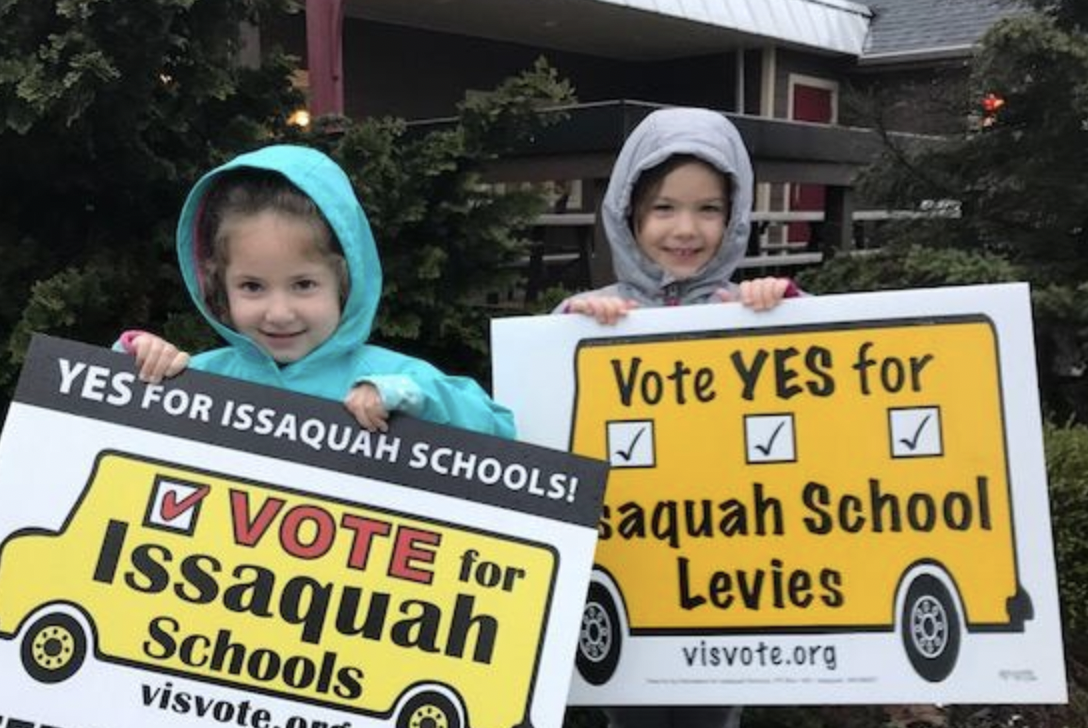

Levies support our local students!

The Educational Programs & Operations (EP&O) Levy pays for educational programs and supports such as mental health counselors, nurses, security staff, and classroom supports.

The Transportation Levy replaces old buses with new, more efficient models that align with the state’s safety standards and replacement cycle. Fuel savings and lower maintenance costs mean more dollars go into the classroom.

The Technology & Critical Repairs Capital Levy provides funding for educational technology and critical repairs for infrastructure, including hardware and software and services not fully funded by the State. For critical repairs, the capital levy includes maintenance of heating and cooling systems, safety and security upgrades, and portable classroom space.

What is the levy rate?

A levy rate is the amount of property tax that voters approve to be assessed for every $1,000 of property value. A levy rate of $1.00 means that for every $1,000 of property value, the owner of the property will pay $1.00 in taxes. For example, if a homeowner’s house is valued at $800,000 and the voters pass a levy at a $1.00 levy rate, the homeowner will pay $800.00 annually in property taxes. Since levies are a fixed dollar amount, if a homeowner’s assessed valuation increases more than the average, his/her levy rate will decrease.

What is a Bond?

Washington does not fund regular building or maintenance of public schools. Instead, local voters approve school bonds. Similar to a mortgage, bonds are paid for over about 20 years, helping to keep costs lower for taxpayers. State law mandates that bond dollars be used only for building and maintenance, not classroom operations; careful bond planning, however, is one critical way districts preserve classroom funds. For instance, if a school boiler fails, the replacement is at least $500,000, equivalent to six teaching positions. If no bond funds are available, classroom operations dollars must be used instead.