Current EP&O Levy Services and Tax Info

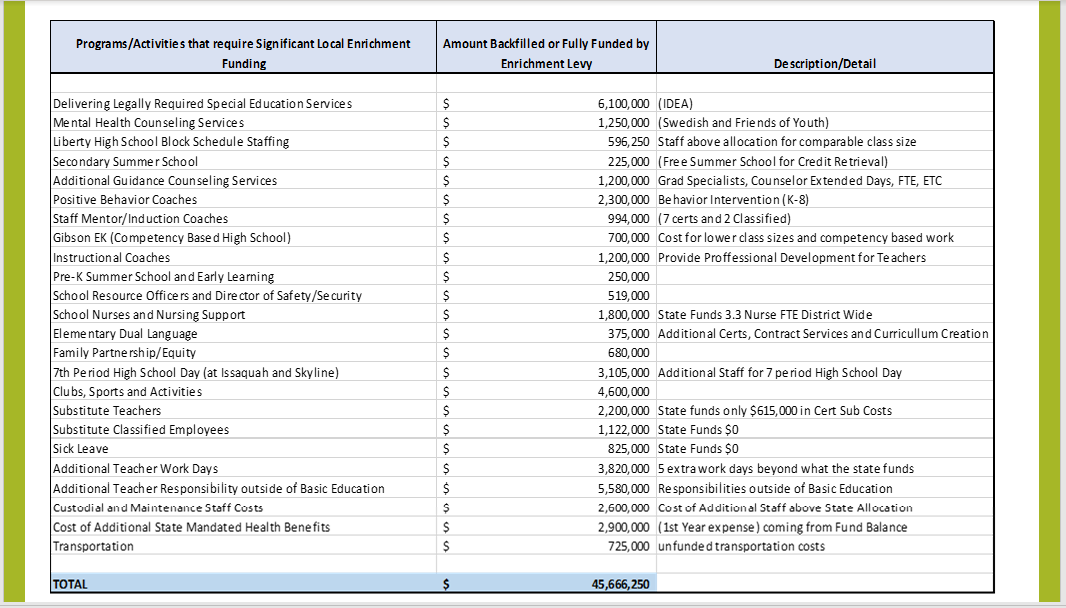

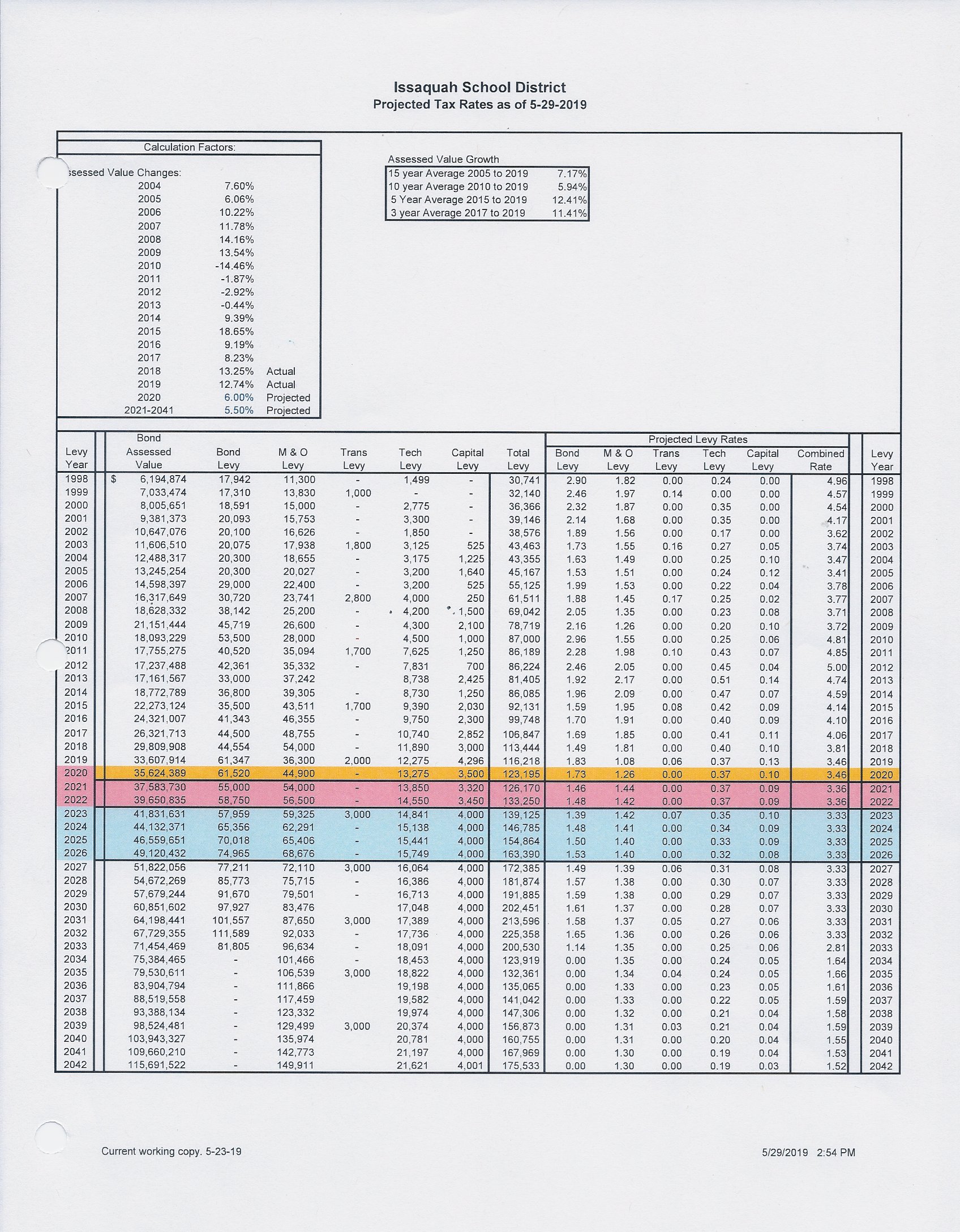

The 2020 ISD Levy Committee is currently reviewing the District’s planning springboard. They are looking at what the current 2018 two-year EP&O levy is paying for (fig. 1) and what the current tax rate is for those services, $1.26/$1,000 for a combined total local tax rate of $3.46/$1,000 (fig. 2).

The District’s proposed 2020 two-year EP&O levy is to maintain the current services and the proposed tax rate looks to be $1.44 (2021) and $1.42 (2022) for a combined total 3.36/$1,000 ( a ten-cent decrease) for 2021 & 2022.

This is for the local school support tax portion of your tax bill only. The State School Part One tax and State School Part Two – McCleary tax are State taxes.

QUESTIONS? COMMENTS? Please reach out to your committee rep (found on roster) or by emailing below.

- E-mail your comments to Levy2020@issaquah.wednet.edu. Your comments will be shared with each committee member at each meeting.

Figure 1 Current Services provided by 2018 EP&O Levy (formerly M&O)

Figure 2 Proposed Tax Rate for 2020 EP&O Levy (formerly M&O)

All information and documents are from Issaquah School District Levy Committee 2020 Materials

Source: https://www.issaquah.wednet.edu/district/levy-development-committee-2020